TRADE FINANCE ENGINEERING SA

Puissance et élégance professionnel

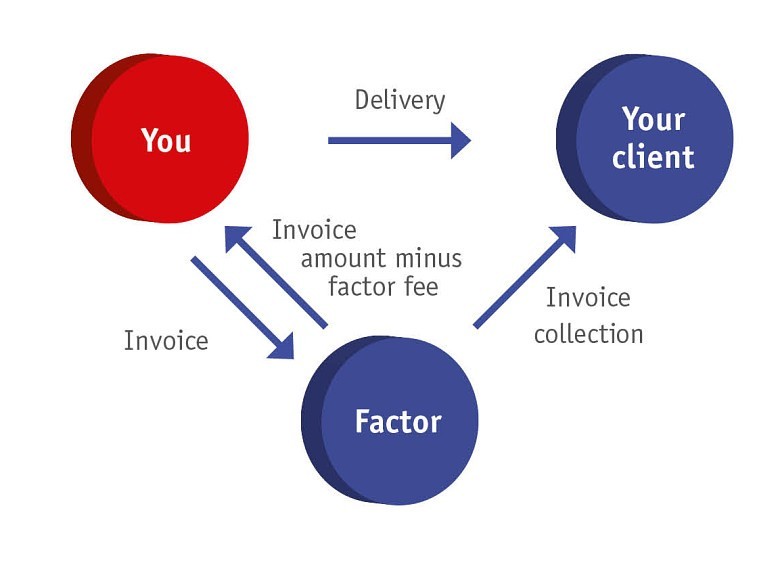

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Whereas invoice discounting is a loan secured against your outstanding invoices, invoice factoring companies actually purchase the unpaid invoices outright. This is an important difference because it provides factoring companies with credit control, which enables them to deal with customers directly.

Invoice Discounting accelerates your cash flow, by enabling you to quickly access cash tied-up in invoices, so you don’t need to wait for your customers to pay.

It’s simple and quick to implement and you receive cash quickly after issuing the invoice. With your diminished cash flow pressures, this can reduce finance costs leaving you free to explore well-earned expansion plans to grow your business.